Salary Tax in Cambodia 2026: Payroll Rules & Tax Rates

Understanding Cambodia's salary tax is important for both local and foreign workers who want to know more about their take-home pay, tax obligations and company duties. With recent changes to Cambodia's income tax law and yearly changes that affect payment duties, it's more important than ever to stay up to date.

In salary tax in Cambodia 2026, the government keeps improving its tax system to make it more clear, make calculations easier and make sure that people of all income levels pay the same amount of tax. Because these changes have a direct effect on monthly payroll calculations, it is very important for both companies and employees to use the most up-to-date income tax rates in Cambodia when planning pay packages.

Knowing how Cambodia's payroll tax works is important whether you're in charge of human resources, running a business, or signing a new job contract. It helps you stay in line, figure out deductions correctly and guess what your net salary will be. The updated framework is meant to make things simpler for people of all income levels from tax-free thresholds to progressive tax brackets and rules for resident vs. non-resident workers.

This new overview for 2025 gives you an up-to-date, clear breakdown of salary tax, recent changes to the law, and what every worker should know before looking at their payslip.

What is Salary Tax in Cambodia?

Workers in Cambodia, whether they are Cambodian or from another country, must pay salary tax, which is also called Tax on Salary (ToS).

The law is an important part of Cambodia's income tax system because it makes sure that everyone pays their fair share of taxes.

Most workers in Cambodia pay salary tax through automatic monthly employer withholding, which makes it easy to follow the rules. This is different from some countries where people have to file personal income tax returns.

1. Progressive Income Tax Rates: Cambodia applies progressive income tax rates to make sure the system is fair. A bigger percentage is paid by people with higher salaries than by people with lower salaries. In 2026, this system will still be in place, but the thresholds will be changed to reflect changes in the economy.

2. Monthly Employer Withholding: Under Cambodia payroll tax rules, employers must calculate and withhold salary tax every month before wages are paid. Employees receive their salary after tax deduction, ensuring timely and accurate remittance to the General Department of Taxation (GDT).

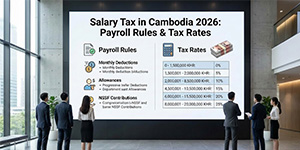

3. Income Classes and Tax Rates: The latest salary tax in Cambodia 2026 brackets are as follows (for resident employees):

- Up to 1,500,000 KHR: 0%

- 1,500,001 – 2,000,000 KHR: 5%

- 2,000,001 – 8,500,000 KHR: 10%

- 8,500,001 – 12,500,000 KHR: 15%

- Above 12,500,000 KHR: 20%

Important Note: Non-resident employees are taxed at a flat 20% on Cambodia-sourced income.

4. Tax Exemptions & Relief: Cambodia offers limited but important forms of relief, including dependent deductions, which reduce the taxable portion of monthly income. However, many items such as NSSF employee contributions do not reduce taxable salary. Employees should check which exemptions apply to optimize their take-home pay.

5. Tax Filing & Compliance Responsibilities: Employers are in charge of withholding and sending the money, but workers still need to report any extra income that wasn't taken out of their paychecks, like rental income or side jobs. Updating yourself on Cambodia's income tax laws is a good way to make sure you follow them completely and avoid fines.

Explore more about the: Average Salary in Cambodia: Exploring Income Levels.

|

How to Calculate Salary Tax in Cambodia?Both workers and employers need to know how to figure out salary tax in Cambodia if they want to make sure their payroll is correct and follow the latest Cambodia income tax law. Cambodia still has a progressive tax system in 2026, but the tax levels have changed and employers' duties have become clearer. This makes it important to follow the right steps when figuring out your taxes. Here is a new, step-by-step guide on how to figure out your Cambodian salary tax for 2026. |

1. Figure out your gross pay: Your monthly salary, before any deductions or taxes are taken out, is called your "gross salary." This includes all types of pay that are taxed under Cambodia's payroll tax scheme.

An individual's gross salary may include:

- Base pay every month

- Bonuses or incentives for good performance

- Bonuses for sales

- Permissions for responsibility

- Not paying on time

- Allowances that are taxed, such as allowance for housing (unless specifically exempt), allowance for travel, allowance for meals or attendance, allowance for positions, perks that aren't cash (if they have a monetary value set by GDT).

Noteworthy 2026 Note: Some companies give funds for things like food, lodging, and gas. These could be fully taxed, partially taxed, or fully taxed, based on how the GDT sees it. Employers must put them in the right category to avoid making mistakes.

2. Determine Your Taxable Income: Once your gross salary is calculated, the next step is identifying how much of it is taxable.

Taxable income = Gross salary − Allowable deductions

Allowable deductions in 2026 may include:

a. Dependent Deductions: Employees can claim deductions for dependents (children or dependent parents). The deduction amount is subject to change by GDT each year, so staying updated is important.

b. Tax-Exempt Benefits: Some employer-provided benefits are not subject to tax when they are:

- Necessary for performing the job

- Reasonable in amount

- Recognized by GDT as non-taxable

Examples: Work uniforms, Business-travel reimbursements, Equipment provided for work purposes, Certain insurance premiums (if company-paid)

c. Specific Allowances Permitted Under Cambodia Payroll Tax Rules: In some cases, transportation, accommodation, or meal allowances may be exempt if classified correctly and compliant with labor and tax standards.

NSSF Reminder:

In 2026, Cambodia also adjusted its statutory wage levels, with the minimum wage for garment, textile and footwear sectors set at USD 210/month under Prakas 214/25 - a slight increase from prior years.

This is relevant when calculating entry-level payroll costs but does not directly change salary tax rates. Employers must still calculate salary tax and NSSF contributions separately for each employee.

3. 2026 Tax Brackets:

Cambodia continues to apply a progressive salary tax (Tax on Salary) on monthly income for resident employees. As of 2026, the tax brackets remain progressive from 0% to 20%. Residents pay:

- 0 % on monthly income up to KHR 1,500,000

- 5 % on the portion from KHR 1,500,001 to KHR 2,000,000

- 10 % on the portion from KHR 2,000,001 to KHR 8,500,000

- 15 % on the portion from KHR 8,500,001 to KHR 12,500,000

- 20 % on the portion above KHR 12,500,000

These thresholds are based on Cambodia’s Tax on Salary structure, which is updated periodically by the Ministry of Economy and Finance. Non-resident employees are subject to a flat 20% tax on Cambodia-sourced salary.*

Why this matters:

This aligns with the most recent PwC tax summary and local Cambodian regulatory data the structure has not materially changed for 2026 but should be affirmed periodically.

|

Salary Tax in Cambodia for ForeignersThe rules for pay tax in Cambodia are the same for foreign workers as they are for Cambodian workers. In order to make sure that the Cambodia income tax law is fair and consistent, the government keeps a unified tax system. However, expats should be aware of a few key changes, especially when it comes to residency status, taxable benefits, and tax breaks that are available. As Cambodia's tax system gets stronger in 2025, foreign workers need to pay close attention to how to calculate their salary taxes, report their payroll and meet all the other requirements for staying in compliance. |

1. Overview of Salary Tax Rules for Foreign Employees

Salary tax officially known as Tax on Salary (ToS) is imposed on all individuals earning income from work performed in Cambodia, regardless of nationality. In 2026:

- Resident foreigners follow the same progressive tax rates as Cambodian nationals.

- Non-resident foreigners are taxed at a flat 20% rate on Cambodia-sourced salary income.

- Income earned outside Cambodia is not taxable unless it is paid for services performed inside the Kingdom.

Cambodia’s tax system places strong emphasis on accurate payroll processing, so expats must understand the structure of Cambodia payroll tax and how deductions are applied to avoid underpayment or penalties.

2. How to Calculate Salary Tax in Cambodia for Foreigners

Foreign employees can calculate their salary tax in 2025 by following these updated steps:

A. Determine Gross Salary

Calculate your total monthly earnings, which may include:

- Base salary

- Fixed monthly allowances

- Bonuses and incentives

- Housing allowances (fully taxable for most expatriates)

- Transportation or meal stipends

- Any monetary benefit provided by the employer

Note: Non-cash benefits provided to foreign staff (e.g., company car, accommodation, school fees) may be considered Taxable Fringe Benefits and are taxed separately at 20% FBT (Fringe Benefit Tax).

B. Apply the Correct Tax Rate Based on Residency

For Resident Foreigners (living in Cambodia ≥182 days/year)

Apply the progressive income tax rates in Cambodia 2026:

- Up to 1,500,000 KHR → 0%

- 1,500,001 – 2,000,000 KHR → 5%

- 2,000,001 – 8,500,000 KHR → 10%

- 8,500,001 – 12,500,000 KHR → 15%

- Above 12,500,000 KHR → 20%

For Non-Resident Foreigners (less than 182 days)

A flat 20% tax rate applies to all income earned in Cambodia.

- No progressive brackets.

- No personal deductions.

Consider Allowable and Non-Allowable Deductions

Foreigners sometimes assume they receive the same deductions as locals but in 2026, this varies:

Deductions Typically NOT available to foreigners:

- Dependent relief

- Certain personal allowances

- Khmer-specific tax reduction programs

Possible deductions (case-by-case):

- Mandatory employee contributions under the National Social Security Fund (NSSF)

- Certain documented professional expenses (only in specific employment structures)

- Contributions to employer-sponsored retirement plans (rare but possible)

Housing Allowance Clarification 2026:

As of 2025, the GDT has tightened enforcement around housing benefits:

- Employer-provided housing = Taxable fringe benefit (20% FBT)

- Cash housing allowance = Taxable as regular salary

- No tax-free housing allowance for expats

New 2026 Compliance Updates for Expat Workers

Cambodia has introduced stronger payroll compliance measures:

- Monthly payroll reports must match tax withholding submissions.

- Employers must maintain digital payroll records for at least 10 years.

- Work permit and tax residency documentation for foreigners are now cross-checked with GDT systems.

- Tax audits increasingly focus on foreign employees receiving untaxed allowances or benefits.

Considerations for Foreigners

- Tax Treaties: Find out if Cambodia and your home nation have any tax treaties. Occasionally, these agreements might reduce the risk of paying taxes twice or modify how your income is taxed.

- Social Security Contributions: Depending on their work contract and status, foreign nationals may also be required to pay into Cambodia's social security system in addition to salary tax.

- Compliance and Tax Filing: Verify that your company properly deducts and sends your salary tax to the Cambodian government. Check the accuracy of your tax statements on a regular basis.

- Expert Advice: It's essential to speak with a tax professional who is knowledgeable about both international tax issues and Cambodian tax legislation due to the complexity of international taxation. They can assist you in resolving any tax-related challenges, maximizing your tax situation, and navigating compliance issues with tax treaties and deductions.

- Keeping Up: Stay informed about any modifications to Cambodian tax laws that may have an impact on your salary tax liabilities. This covers any updates provided by the tax authorities in Cambodia.

Knowing and handling pay tax for international workers in Cambodia entails keeping up with tax treaties, controlling your tax based on progressive rates, and making sure local laws are followed. You can efficiently handle your tax responsibilities in Cambodia by accurately estimating your tax liability and, if necessary, obtaining professional assistance.

Income Tax in Cambodia: Important Concepts for 2026

It is important for workers, employers, and expatriates to know about the salary tax in Cambodia, the most recent income tax rates in Cambodia and the changes that are being made to the Cambodian income tax law until 2026. As Cambodia continues to modernize its tax system, following the rules for Cambodia payroll tax can have a big effect on both your budget and your take-home pay. Here are the most important ideas that have been changed for 2026.

The Cambodian Income Tax Law has been updated for 2025

The General Department of Taxation (GDT) is in charge of the Cambodian income tax law. This law spells out what taxpayers must do, how to file their taxes, and what happens if they don't.

Through the E-Filing and E-Tax Services Portal, the government continues to improve transparency, digital reporting, and regulation in 2026. This makes it easier for people to follow the rules.

Important Parts

Needs for Filing: Most employees still have their taxes taken out by their employers, but people who make extra money from things like rentals, freelance work, or coaching must file their taxes every year through the E-Filing system, which was made better and bigger in 2026.

Digital Bills and Calculations Done for You: The GDT now needs digital tax receipts and promotes the use of online payroll systems to cut down on mistakes and make audits more accurate.

Consequences for Not Following: Late submissions and wrong withholding now come with harsher penalties, such as:

- More severe fines for bad behavior

- Fees for interest

- Business suspension for a short time for multiple violations

By keeping up with these changes, you can stay in compliance and avoid fines that aren't necessary.

Cambodia Payroll Tax

Cambodia payroll tax includes all mandatory deductions and employer obligations. In 2025, the government continues strengthening payroll reporting and compliance through digital reporting and stricter audits.

Components of Cambodia Payroll Tax:

Income Tax on Salary:

- Withheld monthly using the updated 2025 progressive tax brackets, with a new 0% threshold now set at 1,500,000 KHR.

Social Security Contributions (NSSF):

Employers must contribute for:

- Occupational Risk Scheme

- Healthcare Scheme

- Pension Scheme (mandatory as of 2023, but contribution percentages increase annually until 2030)

New in 2026:

Higher NSSF Pension Contribution Rates:

- Contributions increase slightly every year according to the long-term pension rollout plan.

Mandatory Payroll Digital Records:

- Companies must store payroll data electronically for tax audit purposes.

Employers must remit all taxes and NSSF contributions each month to the GDT and NSSF to remain compliant.

How to Deduct Payroll Tax in Cambodia

Knowing what discounts you can use can help you lower your taxable income and increase your net salary.

Common Tax Deductions

NSSF Contributions: Contributions for occupational risk, health care and pensions lower taxable salary.

- Dependent Relief: The deduction per dependent remains applicable but may be adjusted yearly based on Ministry of Economy and Finance updates.

- Contributions to a pension plan (voluntary): Contributions to a pension plan made voluntarily may be tax-deductible if they are clear from the employer's policy.

- Job-Related Expenses: You can subtract only certain, GDT-approved business costs; unofficial costs are not counted.

It is very important to have the right paperwork when collecting deductions, especially during audits.

Year-End Salary Tax Planning in Cambodia

Effective year-end planning can improve your tax outcome and avoid surprises. Best Practices for 2026:

Review Annual Income Sources:

- Combine all salary, allowances, bonuses and side-income to evaluate total liability.

Optimize Deductions:

- Ensure dependents, NSSF contributions, and voluntary pension contributions are declared.

Adjust Income Timing:

- Some employees choose to shift certain commissions or bonuses into the next year to reduce current-year taxable income.

Use Digital Tools:

- The GDT’s updated 2026 online tax calculator and employer payroll platforms help ensure accuracy.

Consult Tax Experts:

- Year-end reviews with tax consultants help avoid mistakes and prepare for potential audits.

Mid-Year Salary Tax Updates in Cambodia

Cambodia often introduces regulatory changes mid-year. Staying updated ensures proper financial planning.

Possible Mid-Year Adjustments:

Updated Tax Brackets:

- The Ministry of Economy and Finance may adjust the 0% threshold or progressive brackets based on inflation.

New Deduction Policies:

- Additional reliefs or dependent updates may be introduced.

Revised NSSF Pension Rates:

- Annual incremental increases are part of the long-term pension rollout schedule through 2030.

Compliance Measures:

- More strict requirements for electronic payroll reporting and digital tax documentation.

Regular review prevents underpayment or overpayment of tax.

Get Professional Help for Salary Tax in Cambodia

Cambodia’s tax regulations continue evolving, and expert guidance can save time and reduce financial risk.

Benefits of Professional Assistance:

Accurate Interpretation of 2026 Rules:

- Professionals help you understand current salary tax in Cambodia 2026 standards.

Optimized Deductions:

- Ensures you claim all legal deductions without risking compliance issues.

Error-Free Filing:

- Reduces the risk of penalties, especially when dealing with multiple income sources.

Strategic Tax Planning:

- Experts provide advice for both mid-year and year-end planning, ensuring your financial strategy aligns with evolving regulations.

Tax advisors make the process smoother and ensure individuals and employers stay protected, compliant and fully updated with the latest tax laws.

Conclusion

Understanding Cambodia's salary tax, including the most recent changes to the country's income tax law and tax rates as well as the country's payroll tax processes, is important for 2026 financial planning and maintaining compliance.

With the updated tax brackets, like the higher 0% tax-free threshold of 1,500,000 KHR, workers can get a better idea of how much money they will get back each month and make more accurate monthly budgets.

To get the best financial results while staying in compliance, both workers and employers should learn how to calculate salary taxes, which exemptions and deductions apply and the difference between resident and non-resident tax rules.

For example, knowing that NSSF payments don't lower taxable income can help people figure out their net salary correctly, and knowing that non-residents are subject to a flat 20% tax remains legal for expatriates.

Furthermore, businesses can avoid fines and make sure better payroll management by staying up to date on changes to Cambodia's payroll tax rules such as deadlines for employer withholding and remittance rules.

Additionally, employees can make smart choices about allowances, benefits and other income streams that may affect their total taxable salary by regularly checking tax updates.

Knowing the latest Cambodian tax rules is important whether you are an employee planning your personal funds, an expat figuring out how to follow the rules in your new country or a business making sure your employees follow the rules for payroll.

Talking to a tax expert who knows about Cambodia's changing tax rules is the best way to get personalized advice.

Staying proactive will help you easily navigate Cambodia's tax system in 2026 maximize your take-home pay, and make sure you follow all current rules.

Read More: What is Payroll in Accounting - Benefits and Examples